How Does the Easy Money Policy Impact Consumers

Easy Money Policy Definition

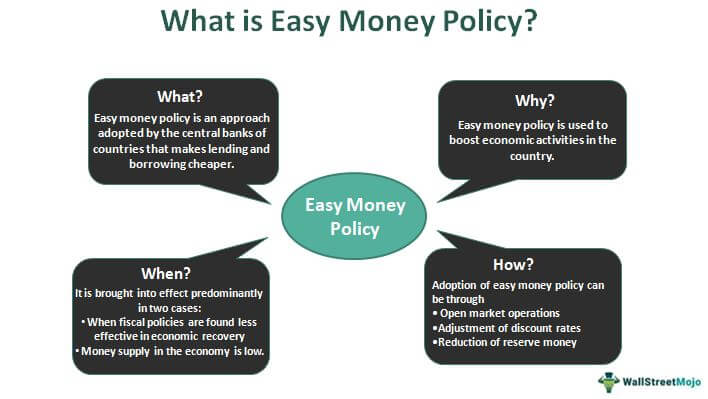

Easy money policy is a policy approach that the central banks of countries adopt where they lower the interest rates associated with lending to make borrowing in the economy cheaper. The banks use this approach when they deem the existing fiscal policies as inadequate for the financial system's recovery.

An easy money policy is often adopted to increase the money supply in the economy. The reduced lending rates encourage more borrowing. When individuals have money to spend, it boosts the economic activity in the country. This contributes to the nation's GDP, thus enhancing the growth of the country.

Table of contents

- Easy Money Policy Definition

- Easy Money Policy Explained

- Tools

- #1 – Open market operations:

- #2 – Discount rate:

- #3 – Reserve requirements:

- Example

- Frequently Asked Questions (FAQs)

- Recommended Articles

- An easy money policy is an expansionary policy adopted by the central banks of various countries to regulate or increase the money supply in the market. Fed easy money policy is one such example.

- It is adopted when the growth slows in an economy. The policy intends to increase the money supply in the economy and encourage growth through it.

- The government adopts various tools to induce an easy money policy and tight money policy.

- In an easy monetary policy, the interest rates are lowered down and it becomes easier for people to borrow. This boosts economic activity and activates an increased money circulation in the economy.

- A change in monetary policy is preferred over a change in fiscal policy since legislation takes a long time to become law and implement spending adjustments.

Easy Money Policy Explained

You are free to use this image on your website, templates, etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Easy Money Policy (wallstreetmojo.com)

Easy money policy, or expansionary monetary policy, is a central bank policy that lowers short-term interest rates. As a result, it makes money less expensive to borrow to boost economic development. Every country's Central Bank is in charge of regulating the country's money supply. For example, The Federal Reserve Bank (Fed) regulates the money supply in the United States. The Fed easy money policy has created a favorable economic environment for the U.S in many instances.

The money supply refers to the total amount of money in circulation. In times of economic slowdown (when the growth rate The Growth rate formula is used to calculate the annual growth of the company for a particular period. It is computed by subtracting the prior value from the current value and dividing the result by the prior value. read more is slow), consumers do not depend on much, and the production declines. The firms, as a result, will have to lay off workers and stop further investments Investments are typically assets bought at present with the expectation of higher returns in the future. Its consumption is foregone now for benefits that investors can reap from it later. read more . The foreign exports may also decline. Overall, demand in the economy reduces. Therefore, it needs an expansionary policy to minimize the effect.

Here, the overnight interest rate (the rate that the central bank charge on banks to borrow money) is lowered as part of an easy money policy. Banks can now borrow at a lower rate. As a result, money becomes more accessible and less expensive for borrowers from lender banks. Demand will increase if enterprises and people can borrow more. An increase in the money supply would invariably result in increased prices. The economy will now come closer to producing at its full capacity. Increased demand will increase the input costs and wages of the workers involved.

These individuals use the new raise in money to buy more goods and services. This acts like a chain reaction for more consumption and wages. Higher orders for businesses indicate more demand for goods in the market. The circulation of money occurs by the buying and selling of these goods and services. More businesses hence aid economic growth Economic growth refers to an increase in the aggregated production and market value of economic commodities and services in an economy over a specific period. read more . As a result, the policy promotes economic growth.

Tools

The government uses a variety of instruments related to easy money policy and tight money policy to increase or decrease the money supply. However, there are three main instruments regulating the money supply: open market operations, discount rates The discount rate refers to the rate of interest that is applied to future cash flows of an investment to calculate its present value. read more , and reserve requirements Reserve Requirement is the minimum liquid cash amount in a proportion of its total deposit that is required to be kept either in the bank or deposited in the central bank, in such a way that the bank cannot access it for any business or economic activity. read more .

#1 – Open market operations

Open market operations are mostly concerned with buying and selling of government securities. Bonds Bonds refer to the debt instruments issued by governments or corporations to acquire investors' funds for a certain period. read more are typically purchased for the same. If the central bank of the U.S. decides to buy government securities, it can draw a cheque in the name of the Federal Reserve System. When the government buys it, banks receive cash that was not in their possession earlier. This money increases their lending capacity. As a result, the demand for government bond prices increases, and the interest rate reduces.

This situation where the credit is available with low-interest rates encourages borrowing. Investors would want to take huge amounts as they have to pay a small interest. As a result, factories, companies, and organizations can open. Production will tend to increase, more people can get employment, and individuals will raise their standard of living. They start to spend more on the goods and services in the market, increasing the money supply in the market. Apart from this, a reduction in interest rates also reduces house loans, where people can enjoy a good amount of disposable income they can further spend in the market.

#2 – Discount rate

Discount rates are the rates on short-term loans that the central bank lends to the country's other banks (commercial banks A commercial bank refers to a financial institution that provides various financial solutions to the individual customers or small business clients. It facilitates bank deposits, locker service, loans, checking accounts, and different financial products like savings accounts, bank overdrafts, and certificates of deposits. read more ). These loans typically address reserve needs or liquidity concerns that banks can't meet through other banks' loans that have a lower federal funds borrowing rate. When the discount rate The discount rate refers to the rate of interest that is applied to future cash flows of an investment to calculate its present value. read more increases, the lending capacity of banks reduces as banks have to pay the higher rate of interest to the central bank. When the rates lowers, banks charge less interest from the borrowers. Since borrowers need less money to pay, they spend it increasing the money supply. In most cases, discount rate signifies changes such as interest rates charged by commercial banks, which will follow it.

#3 – Reserve requirements

There are certain requirements that the central bank lays down to other commercial banks regarding maintaining reserves. It is mandatory that they have to keep their respective resources with the central bank. Banks will have less money to lend when the central bank increases the reserves. When the reserves are low, the bank will have more money to lend. This will increase the market's money supply.

Example

Below is an easy money policy example to give readers a basic understanding of its impact:

The great recession during 2007–2009 was one of the major situations where an expansionary money policy became useful.

The fed fund rate (the central bank of the United States) was 5.25% at the start of the housing market crisis, but the economy had fallen to 4.25% by the time it collapsed. During this period, the Fed extended the period for discount rate loans. This lessened the gap between discount rates and the fed fund rates. All the while, interest rates were declining and hit zero. The situation of the recession was so severe that decreasing interest rates and bringing discount rates to zero had no impact. The United States government conducts open market operations An Open Market Operation or OMO is merely an activity performed by the central bank to either give or take liquidity to a financial institution. The aim of OMO is to strengthen the liquidity status of the commercial banks and also to take surplus liquidity from them. read more . It bought longer-term securities of 20-30 years and other types of securities, including mortgage-backed securities. This helped the U.S. economy An economy comprises individuals, commercial entities, and the government involved in the production, distribution, exchange, and consumption of products and services in a society. read more recover. Bank of England adopted similar methods during the same period and is, therefore, another easy money policy example.

Advantages of Easy money policy

A change in monetary policy is better than a fiscal policy as it takes a lot of time in legislation to become law and initiate spending changes. It isn't easy to reverse once they become law. In addition to it, the concerns about consumers responding positively also exist as they may save rather than spend. However, central banks usually refrain from sustaining an easy money policy (low overnight interest rate) for longer periods as it could lead to inflation. Money's purchasing value erodes when inflation occurs (which means that prices for goods and services increase). As a result, countries' central banks may adjust their monetary policy in response to the economy's demands.

For example, suppose inflation is at a high, and the government of the U.S. wants to keep it under control. In that case, the Federal Reserve Bank may pursue a contractionary monetary policy Contractionary monetary policy is the type of economic policy that is basically used to deal with inflation and it also involves minimizing the fund's supply in order to bring an enhancement in the cost of borrowings which will ultimately lower the gross domestic product and moderate or decrease inflation too. read more or Tight Monetary Policy. On the other hand, if there is a growing demand for investment and unemployment, the bank may follow an easy monetary policy to boost the country's economic activity.

Frequently Asked Questions (FAQs)

What is the easy money policy?

An easy money policy is a type of monetary policy that the central banks of countries adopt to correct the economy's slowdown. It is employed when the signs of recovery are not possible through changes made by a fiscal policy.

Why would the Federal Reserve enact an easy money policy?

Federal Reserve Bank (fed) is the central bank of the U.S, and central banks prefer easy money policies in situations where the money supply in the economy has decreased. This policy aims to increase the money supply in the market through open market operations, discount rates, and reserves.

When is an easy money policy used?

It is used in situations where the economy needs a boost to regain the speed of growth it lost. Central banks use this policy to increase the money supply in order to encourage spending. This is often done by adopting ways to boost economic activity through reduced borrowing rates.

Recommended Articles

This is a guide to the easy money policy and its definition. Here we explain easy money policy along with tools, examples and advantages. You can learn more from the following articles –

- Monetary Policy Monetary policy refers to the steps taken by a country's central bank to control the money supply for economic stability. For example, policymakers manipulate money circulation for increasing employment, GDP, price stability by using tools such as interest rates, reserves, bonds, etc. read more

- Contractionary Monetary Policy Contractionary monetary policy is the type of economic policy that is basically used to deal with inflation and it also involves minimizing the fund's supply in order to bring an enhancement in the cost of borrowings which will ultimately lower the gross domestic product and moderate or decrease inflation too. read more

- Monetary Base The monetary base refers to a measure of money supply in the economy consisting of Federal Reserve System (Central Bank) issued currency circulating outside of Treasury and Federal Reserve through the public and Federal Reserve balances of depository institutions. It is also known as MB or M0. read more

stevensonblene1993.blogspot.com

Source: https://www.wallstreetmojo.com/easy-money-policy/

0 Response to "How Does the Easy Money Policy Impact Consumers"

Post a Comment